Summary of Union Budget 2025-2026

Written and Paraphrased by Adv. Vipul Singh

Union Finance Minister Nirmala Sitharaman presented the Union Budget 2025 on Saturday. She highlighted four key areas driving the country’s growth: agriculture, small businesses (MSMEs), investments, and exports. She explained that reforms act as fuel for this journey, inclusivity is the guiding principle, and the ultimate goal is to build a developed India (Viksit Bharat).

She also mentioned that the Budget focuses on bringing major changes in six key areas: taxation, electricity, urban development, mining, the financial sector, and regulatory policies.

The Union Budget is an important topic for all competitive exams. Here are the key points and highlights of the Budget 2025 announcements. Also, you can learn the basic concepts of the budget at the end of the article.

1). AGRICULTURE

- The government will work towards making India self-sufficient in pulses by increasing the production and purchase of toor, urad, and masur dal.

- A Makhana Board will be set up in Bihar to improve the cultivation and marketing of fox nuts (Makhana). Farmers involved in makhana farming will be organized into Farmer Producer Organizations (FPOs). Bihar produces 85% of India’s makhana, with around 10 lakh people depending on its cultivation. The Bihar government has been asking for more support, including a minimum support price (MSP) for makhana.

- A new 'Rural Prosperity and Resilience' program will be launched with states to reduce under-employment in agriculture. This initiative will promote skills, investment, technology, and rural economic growth, creating more job opportunities in villages so people don’t have to migrate for work. Special focus will be given to rural women, young farmers, small and marginal farmers, and landless families.

- A National Mission on High Yielding Seeds will be introduced to:

- Improve research on better seeds.

- Develop seeds that give higher yields, resist pests, and withstand climate changes.

- Ensure that over 100 new seed varieties, released since July 2024, are available for commercial use.

- A 5-year 'Mission for Cotton Productivity' has been launched to support cotton farmers.

- The government will create a policy framework to promote sustainable fishing in India's Exclusive Economic Zone and international waters, focusing on Andaman & Nicobar and Lakshadweep Islands.

- India Post and India Post Payments Bank will be transformed to boost the rural economy and become a large public logistics organisation

- The loan limit under the Modified Interest Subvention Scheme for Kisan Credit Card (KCC) loans will be increased from ₹3 lakh to ₹5 lakh.

- A new scheme, Prime Minister Dhan Dhanya Krishi Yojana (PMDDKY), will be launched in 100 districts (Agricultural Distric) in the first phase. It will be similar to the Aspirational Districts Programme (ADP), which started in 2018 and covers 112 districts.

- A new urea plant will be set up in Namrup, Assam, with an annual capacity of 12.70 lakh tonnes. This will be the 7th new urea plant in India since 2019. Other plants are in (Gadepan)Rajasthan, (Ramagundam)Telangana, (Panagrah)West Bengal, (Gorakhpur)Uttar Pradesh, (Barauni) Bihar, (Sindhi)Jharkhand, and (Talcher)Odisha .

- The government will support the National Cooperative Development Corporation (NCDC) to help in providing loans to the cooperative sector.

2).MSMEs (Micro, Small, and Medium Enterprises)

- To help MSMEs grow, investment and turnover limits for their classification will be increased by 2.5 times and 2 times, respectively. This will allow them to expand, adopt new technology, and access more funding.

- Credit Guarantee Cover will be increased to improve loan access:

- For Micro and Small Enterprises, from ₹5 crore to ₹10 crore, leading to ₹1.5 lakh crore in additional credit over the next 5 years.

- For Startups, from ₹10 crore to ₹20 crore, with a lower guarantee fee of 1% for loans in 27 key sectorsunder the Atmanirbhar Bharat initiative.

- For exporting MSMEs, credit guarantee will be available for term loans up to ₹20 crore.

- To support micro industries, the government will introduce customized credit cards under the Udyam portal, with a ₹5 lakh credit limit. In the first year, 10 lakh cards will be issued.

- A new Fund of Funds for startups will be created with an additional ₹10,000 crore contribution. So far, ₹91,000 crore has already been committed to Alternate Investment Funds (AIFs), which are supported by Fund of Funds for startups ₹10,000 crore government fund .

- A new loan scheme will offer up to ₹2 crore in term loans to first-time entrepreneurs from women, Scheduled Castes (SC), and Scheduled Tribes (ST) communities.

- To boost India's toy industry, the government will expand the National Action Plan for Toys and promote ‘Make in India’ to make the country a global hub for toy production.

- As part of its focus on developing eastern India (Purvodaya), the government will establish a National Institute of Food Technology, Entrepreneurship, and Management in Bihar.

- A National Manufacturing Mission will be launched to support small, medium, and large enterprises under the Make in India initiative. This mission will provide policy support, execution roadmaps, governance, and monitoring for both central ministries and states.

- The National Manufacturing Mission will also promote clean technology manufacturing to support climate-friendly development. Key focus areas will include:

- Solar PV cells

- Electric vehicle (EV) batteries, motors, and controllers

- Electrolysers (for hydrogen production)

- Wind turbines

- High-voltage transmission equipment

- Large-scale energy storage batteries

3). INVESTMENTS

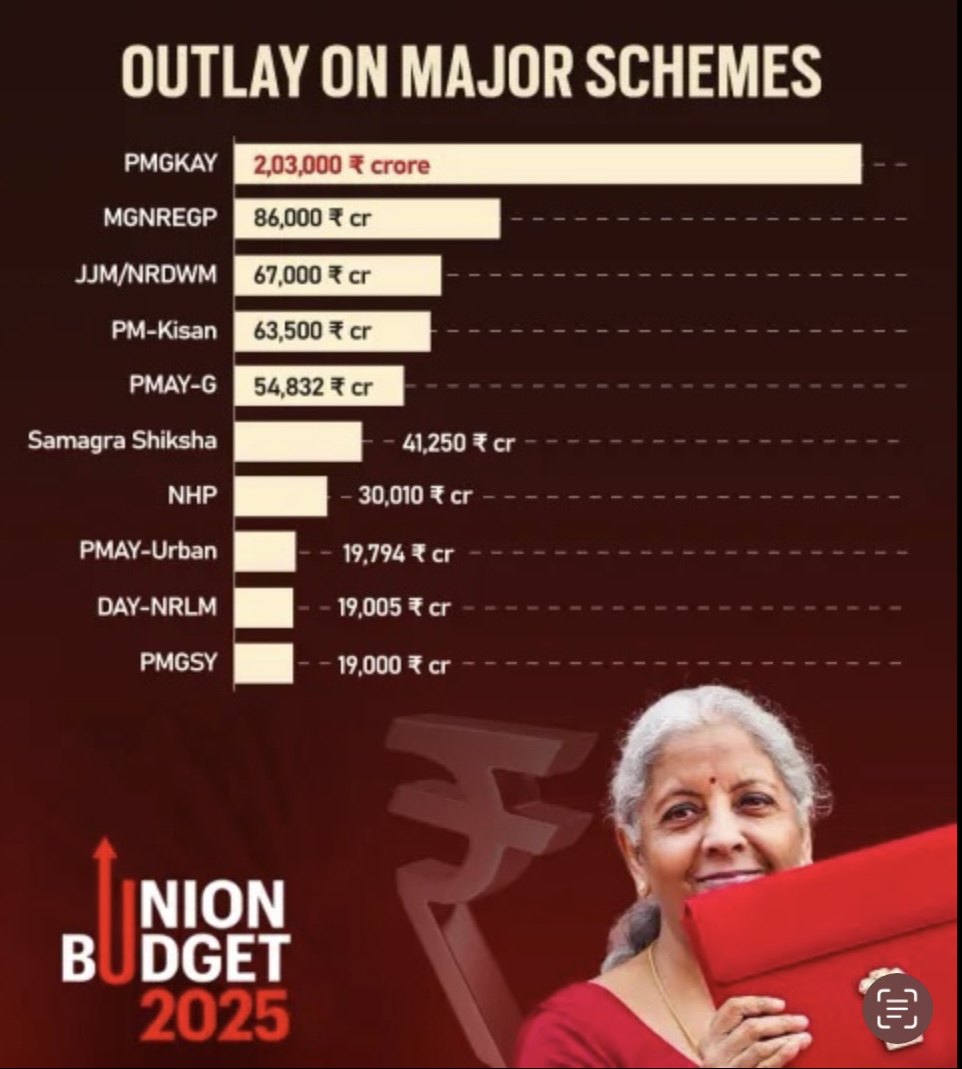

- The Jal Jeevan Mission will be extended until 2028 to ensure 100% coverage of clean drinking water to all households.

- The government will create a ₹1 lakh crore Urban Challenge Fund to support projects like Cities as Growth Hubs, Creative Redevelopment, and Water & Sanitation. The fund will cover up to 25% of viable project costs, while at least 50% funding must come from bonds, bank loans, or public-private partnerships (PPPs). ₹10,000 crore is allocated for 2025-26.

- A Nuclear Energy Mission will be launched with ₹20,000 crore to research and develop Small Modular Reactors (SMRs) for cleaner energy production.

- The Shipbuilding Financial Assistance Policy will be revised to reduce cost disadvantages. New measures include:

- Credit Notes for recycling ships in Indian shipyards to support the circular economy.

- Adding large ships (above a certain size) to the infrastructure master list (HML).

- Developing Shipbuilding Clusters with better infrastructure, training, and technology to expand ship production.

- A ₹25,000 crore Maritime Development Fund will be set up to support the shipping and port sector.

- SWAMIH Fund 2 will be launched with contributions from the government, banks, and private investors to complete 1 lakh housing units.

- Tourism Development Plan will focus on top 50 tourist destinations, in collaboration with states. Key initiatives include:

- Skill development programs in Hospitality Management Institutes.

- MUDRA loans for homestays.

- Better travel connectivity to tourist destinations.

- Performance-based incentives for states to improve cleanliness, infrastructure, and marketing of tourist sites.

- Simplified e-visa process and visa-fee waivers for selected tourist groups.

- Special focus will be on sites related to Lord Buddha's life and medical tourism, with easier visa rules and private sector collaboration.

- A modified UDAN scheme will improve regional air connectivity by adding 120 new destinations, carrying 4 crore passengers over the next 10 years. The scheme will also support helipads and small airports in hilly and remote areas, including the North-East and aspirational districts.

- Innovation & Research Investments:

- A ‘Deep Tech Fund of Funds’ will be set up to support next-generation startups.

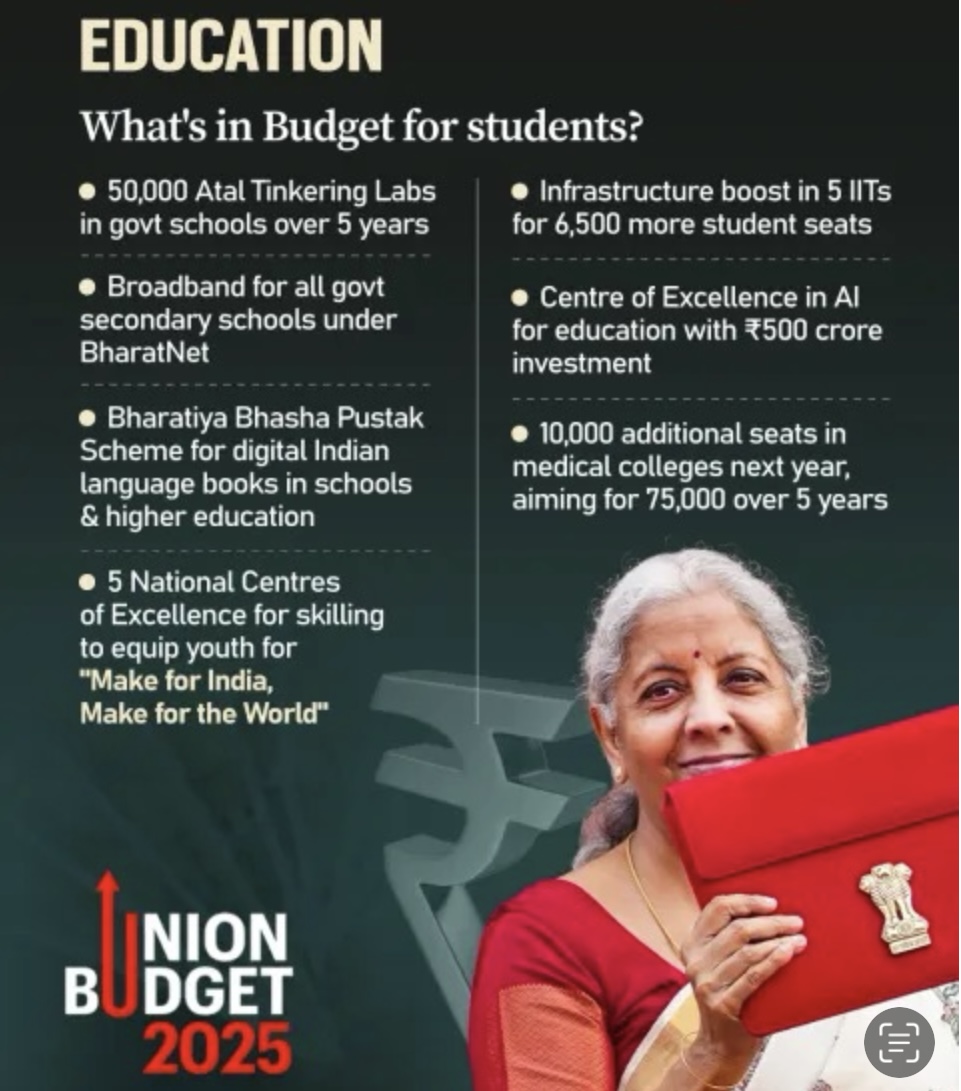

- 10,000 PM Research Fellowships will be awarded in IITs and IISc over the next 5 years to boost technological research.

- A 2nd Gene Bank will be set up with 10 lakh germplasm lines to ensure future food and nutrition security, benefiting both public and private sectors.

- A National Geospatial Mission will develop core geospatial infrastructure and data for better land planning and mapping.

- Gyan Bharatam Mission will be launched to survey, document, and preserve India's manuscript heritage, collaborating with universities, museums, libraries, and private collectors to record over 1 crore manuscripts.

- A National Digital Repository of Indian Knowledge Systems will be created to store and share traditional Indian knowledge.

Bihar-Specific Investments

- New Airports – Greenfield airports will be built in Bihar to meet future demand, supporting Patna airport expansion and a new brownfield airport at Bihta.

- Western Koshi Canal Project – Financial support will be given for this project to help farmers in the Mithilanchal region, improving irrigation for over 50,000 hectares of land.

4). EXPORTS

- A new Export Promotion Mission will be launched to improve access to export credit and help MSMEs expand in global markets.

- BharatTradeNet, a unified digital platform, will be developed to simplify international trade documentationand provide better financing options for exporters.

- The government will support domestic manufacturing to help India become a stronger part of global supply chains. Special focus will be on Industry 4.0 technologies and developing youth talent.

- A National Framework for Global Capability Centres (GCCs) will be introduced to promote global business service hubs in tier-2 cities, improving both infrastructure and skilled workforce availability.

- Air cargo infrastructure will be improved, and customs processes will be streamlined to make it easier to export perishable goods like fruits, vegetables, and dairy products.

Major Financial Sector Reforms Announced in the Budget

- FDI in Insurance Sector:

- Foreign Direct Investment (FDI) limit in the insurance sector is increased from 74% to 100% for companies that invest fully within India.

- The government will simplify and review foreign investment rules to attract more investors.

- Expanding India Post Payment Bank Services:

- India Post Payments Bank (IPPB) will expand its services to reach more rural areas, helping people access banking facilities more easily.

- Credit Enhancement Facility by NaBFID:

- A new Partial Credit Enhancement Facility will be introduced to make it easier for companies to raise funds through corporate bonds for infrastructure projects.

- Grameen Credit Score:

- Public Sector Banks will create a credit score system for rural borrowers, including Self-Help Group (SHG) members, to improve their access to loans.

- Pension Sector Reforms:

- A new forum will be set up to coordinate regulations and develop new pension products for better retirement security.

- KYC Simplification:

- The Central KYC Registry will be revamped in 2025, making it easier for people to update their KYC (Know Your Customer) details with streamlined periodic updates.

- Merger of Companies:

- The process for approving company mergers will be simplified, and fast-track merger procedures will be expanded to make business operations smoother.

- Bilateral Investment Treaties (BITs):

- India has signed two new investment treaties in 2024 and will revamp the BIT model to make it more attractive and investor-friendly.

- Regulatory Reforms:

- The government is committed to improving the Ease of Doing Business by introducing simpler and less restrictive regulations.

- Old regulations will be updated to align with new technology and global policies.

- High-Level Committee for Regulatory Reforms:

- A committee will be set up to review non-financial sector regulations, licenses, and compliance rules.

- It will provide recommendations within a year to improve business governance and regulatory efficiency.

- Investment Friendliness Index of States:

- A new Investment Friendliness Index will be launched in 2025 to encourage healthy competition among states and promote investment-friendly policies.

- FSDC Mechanism:

- The Financial Stability and Development Council (FSDC) will evaluate financial regulations and develop a better framework to make the financial sector more efficient and responsive.

- Jan Vishwas Bill 2.0:

- The government will introduce a new bill to decriminalize over 100 provisions in various laws, reducing unnecessary legal burdens on businesses and individuals.

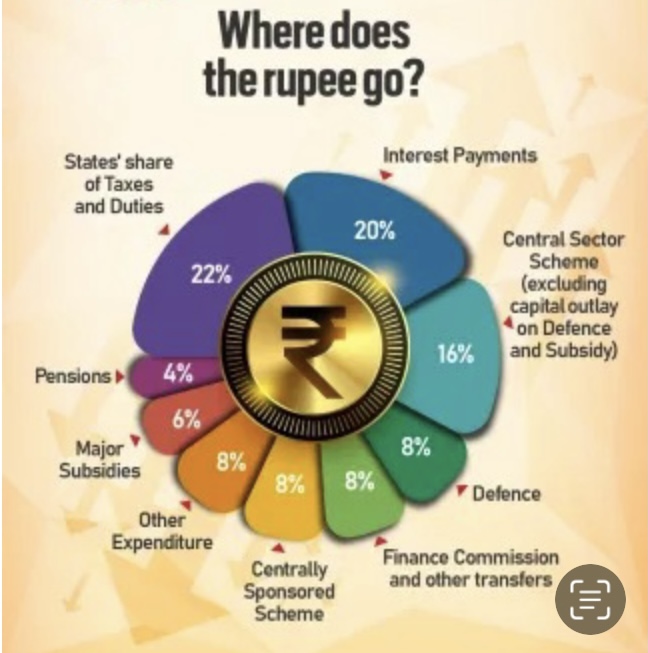

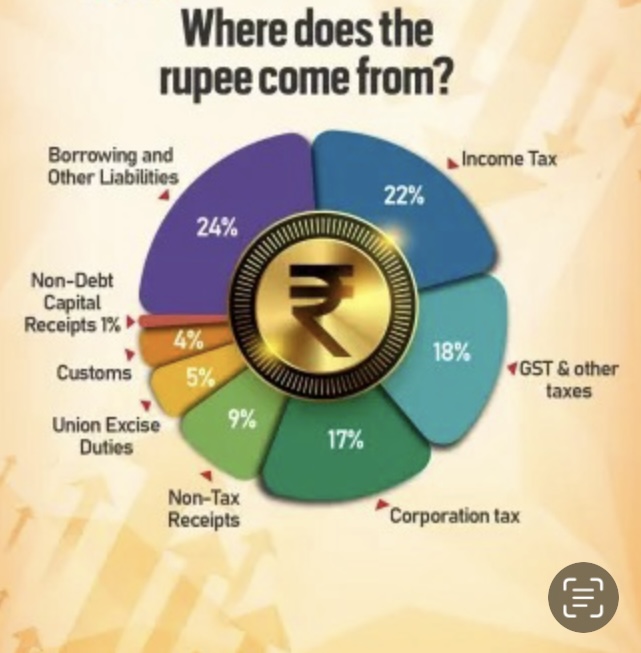

Fiscal Consolidation in the Budget

Revised Estimates for 2024-25:

- Total revenue (excluding borrowings): ₹47 lakh crore.

- Net tax collection: ₹25.57 lakh crore.

- Total government spending: ₹47.16 lakh crore.

- Capital expenditure (long-term investments like infrastructure): ₹10.18 lakh crore.

- Fiscal deficit (the gap between revenue and spending): 4.8% of GDP.

Budget Estimates for 2025-26:

- Total revenue (excluding borrowings): ₹96 lakh crore.

- Total government spending: ₹50.65 lakh crore.

- Net tax collection: ₹28.37 lakh crore.

- Fiscal deficit target: 4% of GDP (lower than last year).

- How the government will cover the deficit:

- ₹54 lakh crore from market borrowings (loans from investors).

- The remaining funds from small savings (like PPF, NSC) and other sources.

- Total borrowing from the market: ₹14.82 lakh crore.

Budget Announcements on Indirect Taxes

- Simplifying Customs Tariffs:

- The government will remove 7 different tariff rates to simplify the structure.

- Some items will have lower tax rates.

- Only one cess or surcharge will be applied to certain goods.

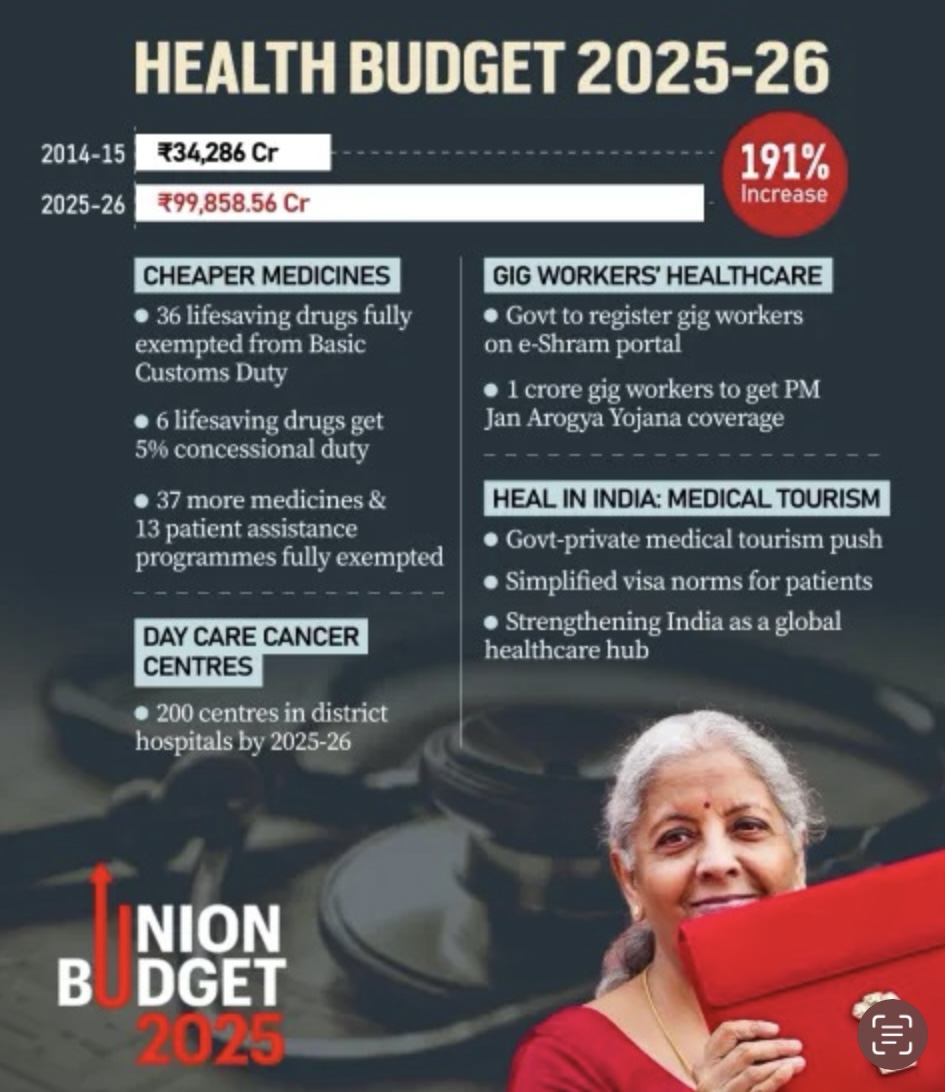

- Lower Taxes on Essential Medicines:

- 36 lifesaving medicines will be completely exempt from Basic Customs Duty (BCD).

- 6 more medicines will have a reduced 5% duty.

- Boost to Domestic Manufacturing:

- Critical materials like cobalt powder and lithium-ion battery scrap will be exempted from customs duty.

- This will encourage local production and create jobs.

- Support for the Textile Industry:

- Certain textile machines will be exempt from customs duty.

- Customs duty rates on knitted fabrics will be revised to promote local manufacturing.

- Changes in Electronics Sector Duties:

- Higher Basic Customs Duty (BCD) on Interactive Flat Panel Displays.

- Lower BCD on Open Cells for TVs.

- Parts of Open Cells for LCD/LED TVs will now be duty-free.

- Encouraging EV and Mobile Battery Manufacturing:

- 35 new capital goods for EV battery production will be added.

- 28 capital goods for mobile phone battery production will also be included.

- Support for Shipping Industry:

- Exemption of BCD on shipbuilding materials and shipbreaking will be extended for 10 more years.

- Boosting Exports:

- Handicrafts can now be exported for a longer period.

- Export duty on crust leather will be removed.

- Lower BCD on seafood products to support the fisheries export industry.

- Faster Trade Assessments:

- Customs assessments must be completed within 2 years (extendable by 1 year).

- This will reduce delays and uncertainty for businesses.

- Encouraging Voluntary Compliance:

- Importers and exporters can voluntarily report details and pay duties with interest.

- No penalties will be applied unless an audit or investigation has already started.

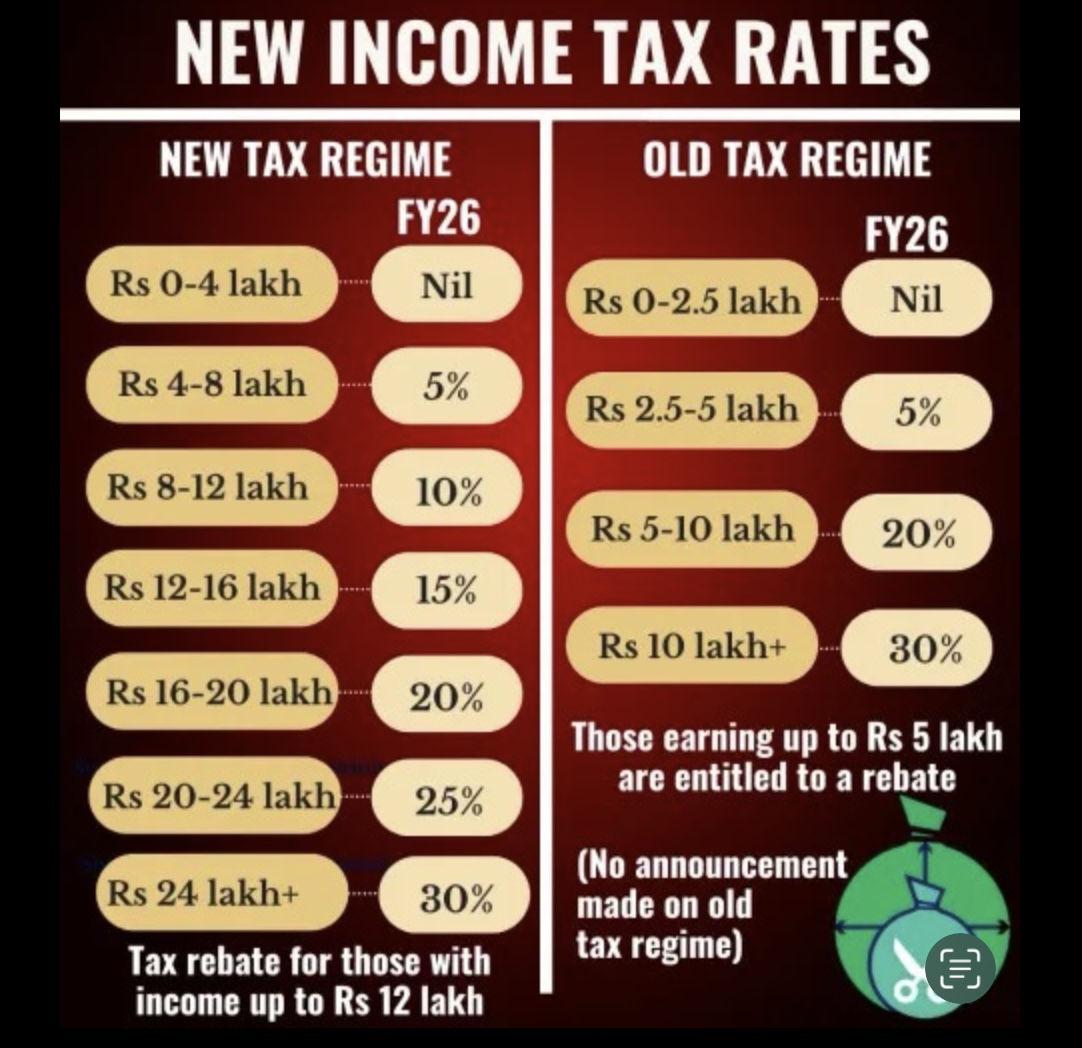

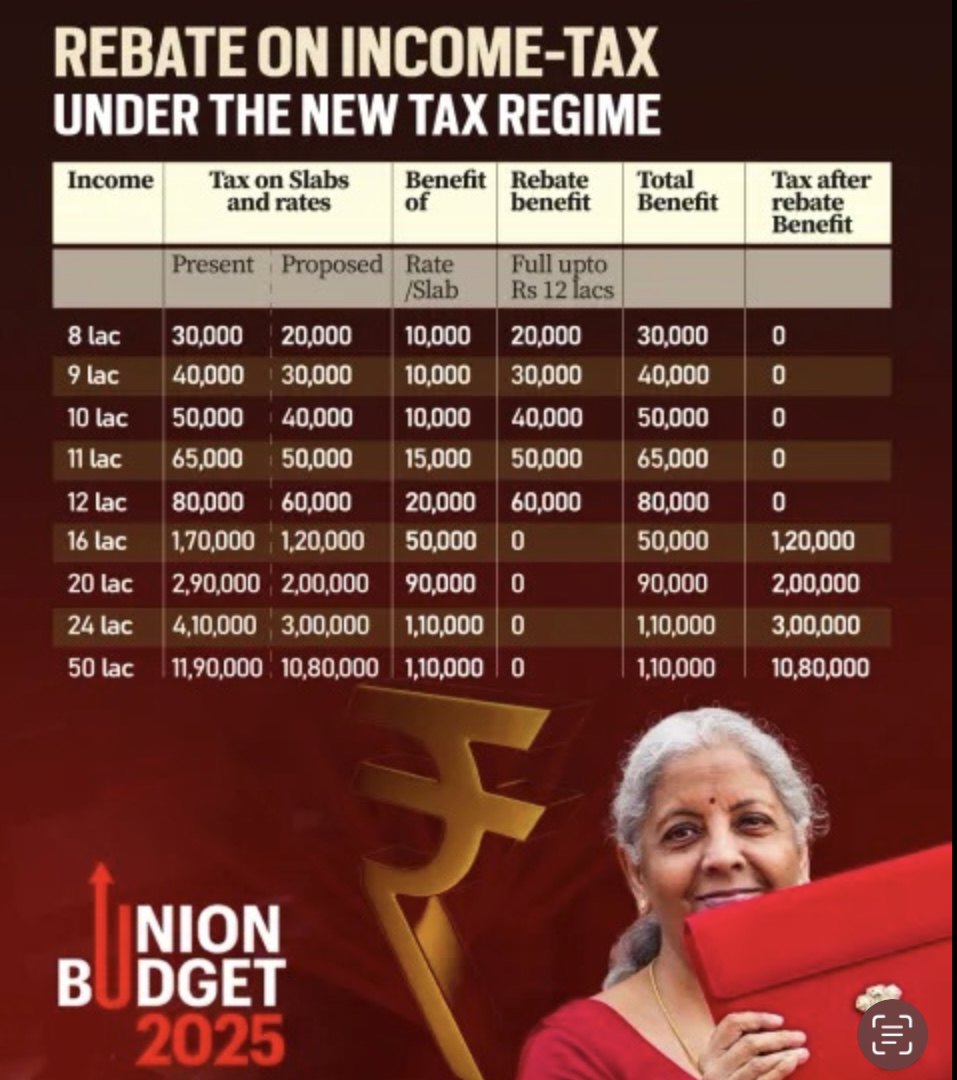

Budget Announcements on Direct Taxes (Including Income Tax)

- Simplifying TDS/TCS Rules:

- The number of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) rates will be reduced.

- Higher exemption limits for senior citizens and rental income.

- No TCS on money sent abroad for education loans or purchasing goods.

- Higher TDS will only apply if PAN is not provided.

- TCS violations will no longer be a criminal offense.

- Encouraging Voluntary Tax Compliance:

- Taxpayers will now have 4 years instead of 2 years to file updated income tax returns.

- Lower Compliance Burden for Taxpayers:

- Charitable trusts will get a 10-year registration period instead of frequent renewals.

- Taxpayers can now claim tax benefits on two self-occupied properties without restrictions.

- Making Business Taxation Easier:

- A new scheme will be introduced to determine fair prices for international transactions.

- Safe Harbour rules will be expanded to reduce tax disputes.

- All tax appeal orders are now digitized to improve efficiency.

- Boosting Investment and Job Creation:

- Electronics manufacturing will get stable tax policies to encourage investment.

- The tonnage tax scheme (which lowers taxes for shipping companies) will be extended to inland water vessels.

- Startups will get a 5-year extension to qualify for tax benefits.

- More tax incentives for International Financial Services Centres (IFSCs) and Alternative Investment Funds (AIFs).

Tax Cuts and Benefits:

- The government will lose Rs 1 lakh crore in direct tax revenue and Rs 2,600 crore in indirect tax revenue due to tax reductions.

- Higher TDS exemption on rent: The TDS-free limit on rent is now Rs 6 lakh per year, up from Rs 2.4 lakh, benefiting small landlords.

Basics of the Union Budget

- What is the Union Budget?

- The Union Budget (officially called the Annual Financial Statement under Article 112 of the Indian Constitution) presents the government’s financial status.

- It explains:

- How much money the government earned last year.

- Where it spent the money.

- How much it borrowed to cover the gap.

- It also gives projections for the next financial year, including:

- Expected earnings.

- Planned expenditures.

- Estimated borrowings to cover the shortfall.

- The budget has two main parts:

- Revenue Section (money earned and spent on regular expenses).

- Capital Section (money used for infrastructure, loans, and investments).

- Important Budget Documents

- Along with the Finance Minister’s Budget Speech, several important documents are presented in Parliament:

- Annual Financial Statement (AFS) – Under Article 112, this document presents a detailed account of government finances.

- Demands for Grants (DG) – Under Article 113, it lists the funds required by different ministries and departments.

- Finance Bill – Under Article 110, it includes changes in tax laws and financial proposals for the year.

- Macro-Economic Framework Statement – Gives an overview of the overall economic situation.

- Medium-Term Fiscal Policy and Fiscal Policy Strategy Statement – Outlines government financial planning for the next few years.

Important Terms Related to the Budget

- Revenue Budget

- Includes government’s earnings (revenue receipts) and expenses (revenue expenditure).

- Revenue comes from taxes and non-tax sources (like interest, fees, and dividends).

- Revenue Expenditure

- Money spent on daily government operations, public services, subsidies, and interest payments on loans.

- It does not create new assets for the government.

- Capital Budget

- Includes capital receipts (money the government borrows) and capital expenditures (money spent on building assets).

- Covers expenses on infrastructure, machinery, land, shares, and loans to states and government companies.

- Fiscal Deficit

- The gap between total government spending and its revenue (excluding borrowings).

- It shows how much money the government needs to borrow.

- Demands for Grants

- Under Article 113, the government presents expenditure estimates that need approval from the Lok Sabha.

- These requests are made for various ministries and departments.

- Money Bill

- Defined under Article 110, it deals with taxes, government borrowings, and spending from the Consolidated Fund of India.

- The Lok Sabha has the final say, and the Rajya Sabha’s recommendations are not mandatory.

- Finance Bill

- Presented along with the Budget as per Article 110(1)(a) of the Constitution.

- It includes proposals for introducing, changing, or removing taxes.

- Difference from a Money Bill:

- The Rajya Sabha (Upper House) can give suggestions on a Finance Bill, but the Lok Sabha (Lower House) can accept or reject them.

- In contrast, a Money Bill does not require Rajya Sabha’s approval.

Conclusion

The Union Budget presents a strategic vision for economic growth, fiscal discipline, and social welfare. It balances infrastructure development, job creation, and industrial growth with targeted support for MSMEs, startups, and rural development. The focus on investment in green energy, digital infrastructure, and technological innovationaligns with India’s long-term economic aspirations.

On the fiscal front, the government has maintained a responsible approach by reducing the fiscal deficit while ensuring sustained capital expenditure. Tax reforms aim to simplify compliance and promote voluntary participation, benefiting businesses and individuals alike.

However, challenges remain, including global economic uncertainties, inflation management, and effective implementation of policy measures. The success of the Budget will depend on efficient execution, stakeholder participation, and adaptability to evolving economic conditions.

Overall, the Budget strives to create a sustainable, inclusive, and investment-friendly economy, fostering both domestic and global confidence in India’s economic trajectory.

References:

https://www.thehindu.com/business/budget/

https://static.pib.gov.in/WriteReadData/specificdocs/documents/2025/feb/doc202521493001.pdf